- Home

- Employers

-

Members

-

Member Resources for Funding Advantage & Individual Advantage

>

- Explanation of Benefits for Funding Advantage Members

- Member FAQs

- Member-Hybrid >

- Member-Traditional >

- Member-Essentials >

- Member-PPO >

- Member-Cost Saver >

- Member-Minimum Essential Coverage >

- Member - Community Health Plan >

- Member-H&H PLan >

- Member-Vault PPO Resources >

- Member-Vault RBP >

- Member-Fundamental Care

- Member-Fundamental Care Value Plan

- Member Resources for Individual Advantage

- Benefit Extras >

- Self-Service Login >

- Find A Provider

- Prescription Benefits

- Member Download Forms >

-

Member Resources for Funding Advantage & Individual Advantage

>

-

Agents

- Provider

- About Us

- Contact Us

|

Would you agree that your employees are the best asset for your small business? Hopefully you answered with a resounding YES! It’s important for employers to encourage healthy habits at the office that lead to good heart health.

Building a healthy workplace and workforce has a number of benefits such as: increased productivity, less absenteeism and ample health-spend savings for both employees and employers. Some health plans – like Allied National’s Freedom Plans – even offer a refund at the end of a healthy plan year. February is American Heart Month and so we came up with five easy ways to keep your employees happy and heart healthy. Download our infographic at the end of this blog.

16 Comments

Employers looking for an easy, affordable way to add value to their employee benefits packages should consider adding dental and vision benefits to their group health plans.

According to Willis Towers Watson’s 2019/2020 Global Benefits Attitudes Survey, 42% of employees would sacrifice additional pay each month for a more expansive health benefit plan, a sharp increase from 27% in 2013. The Affordable Care Act (ACA) has had a profound impact on small group health insurance. Rates have increased significantly as a result of the ACA. These rate increases have been particularly difficult for small groups.

This is where a level-funded health plan could be a good fit for your small business. The new year is finally here and also a new round of Federal Government COVID relief. Thankfully, there is help available for your small business.

Get ready for round two of the Paycheck Protection Program (PPP). Smaller businesses that did not receive a PPP loan the first time around could begin to apply on Monday, Jan. 11. Those that did receive one of the original loans can apply for a second PPP loan beginning today, Wednesday, Jan. 13, provided they meet eligibility requirements. Preferred Provider Organizations (PPOs) date back to 1980 when the first PPO was organized to provide contracted rate medical care to a health plan. For providing “steerage” toward the medical providers in the PPO network, the providers granted discounted rates for their services to the health plan.

Over the years, PPOs have changed and morphed into multiple variations, but the end result is the same – health plan members are steered toward PPO providers for their medical care and given favorable discounted rates. The advantage of this type of arrangement is very obvious – it’s price. Having health insurance is one of the most important steps you can take to protect yourself and your loved ones. We insure our cars, home and other material items, so why would you decide to put yourself last? Car or home repairs can be very costly, but have you thought about what it would cost to fix YOU if something went wrong? Did you know that in 2020, the average cost to treat a concussion in an emergency room is $18,454?

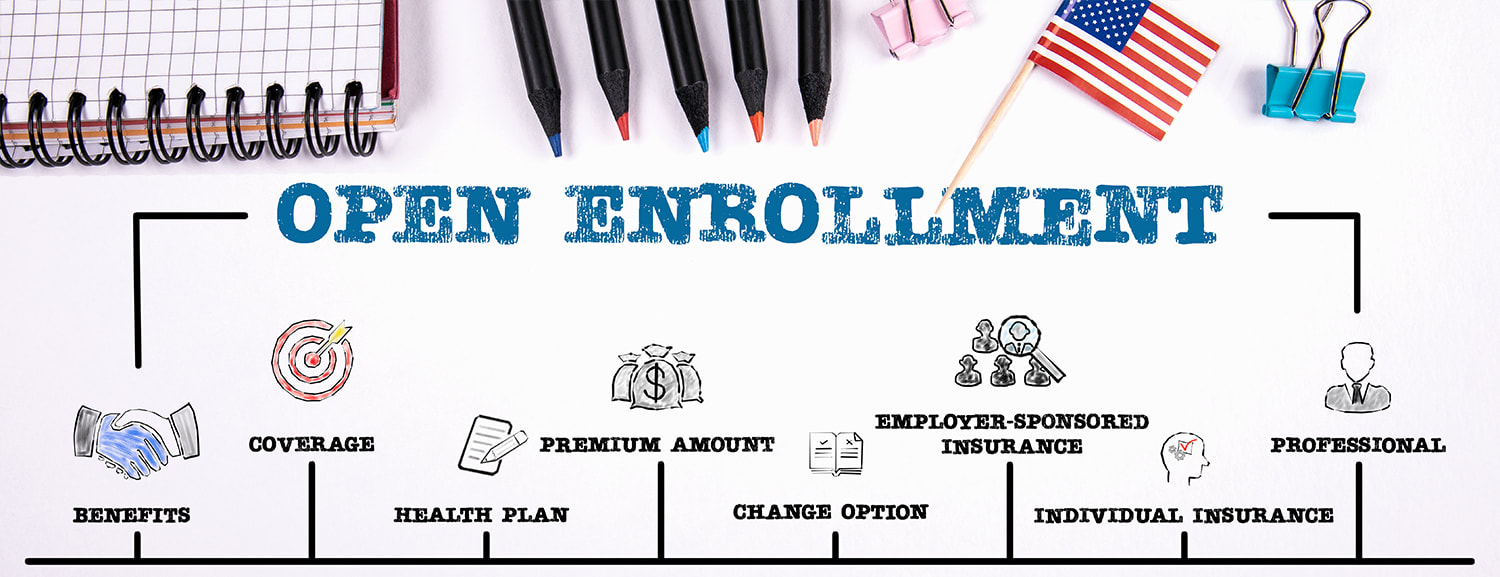

There’s a reason that 49% of Americans receive their health insurance through an employer-sponsored health plan. It’s a tax-advantaged way for an employer to provide “income” to an employee. It’s not really income--there’s nothing extra in an employee’s paycheck. However, it is tax free additional compensation in the form of health insurance benefits for an employee, and it’s tax-deductible for an employer to provide the benefits.

To understand why we have employer-sponsored health plans, a quick history lesson is needed. It’s that time of year again for many employers. Health insurance renewals may feel like a pain; however, they may be one of the most important decisions you make each year.

Your renewal is the time to start a conversation with your agent or broker about whether your current plan is working well for you and what type of renewal options may be available for your small business. If you’re like a lot of employers, your group health benefit plan is up for renewal in the fall. Have you considered what you might do if the increase in premiums is more than you can afford?

It never hurts to shop around. Just make sure you’re not focusing only on price. An inexpensive plan might cost you and your employees more in the long run. Here are a few questions you should ask your broker about your plan options. The coronavirus pandemic has made it more important than ever to disinfect and properly clean your home, office and car to reduce the spread of COVID-19.

There are many unknowns about the COVID-19 germ and the surfaces it lives on. According to the Department of Homeland Security, the average influenza virus can survive on surfaces and still infect a person for up to two to eight hours after being deposited on the surface. Are you sure you have been cleaning and disinfecting the proper way? |

Welcome to the Allied BlogAllied NationalAllied National is a 90 Degree Benefits Company, a subsidiary of Blue Cross Blue Shield of Alabama. Founded in 1970, Allied National is one of the nation's oldest and most experienced third-party administrators. We're the small group benefit experts working to provide unique and affordable group health benefits to small business employers. Categories

All

|

|

© 2022 Allied National, LLC. All Rights Reserved.

|

- Home

- Employers

-

Members

-

Member Resources for Funding Advantage & Individual Advantage

>

- Explanation of Benefits for Funding Advantage Members

- Member FAQs

- Member-Hybrid >

- Member-Traditional >

- Member-Essentials >

- Member-PPO >

- Member-Cost Saver >

- Member-Minimum Essential Coverage >

- Member - Community Health Plan >

- Member-H&H PLan >

- Member-Vault PPO Resources >

- Member-Vault RBP >

- Member-Fundamental Care

- Member-Fundamental Care Value Plan

- Member Resources for Individual Advantage

- Benefit Extras >

- Self-Service Login >

- Find A Provider

- Prescription Benefits

- Member Download Forms >

-

Member Resources for Funding Advantage & Individual Advantage

>

-

Agents

- Provider

- About Us

- Contact Us

RSS Feed

RSS Feed